Insurance is a relationship-driven business. Behind every relational business is a vault of sensitive data. From personal information to client policies and financial details, agencies rely on new technology now more than ever.

The challenge? Keeping this data safe in an ever-changing technological landscape. Hackers get more and more skilled with exploits and tactics while data breaches cost only continue to get more costly to fix. Many small to medium-sized insurance agencies struggle with IT issues as they juggle the time, costs, client trust, cybersecurity, and more.

Before your agency gets in over its head, let’s take some time to break down to the biggest challenges that the insurance industry faces in 2025 and how you can solve them.

Protecting Client Data

Cybercriminals love getting their hands on sensitive information from businesses and organizations by compromising weak (or non-existent) cybersecurity. With how much sensitive client information insurance agencies handle, cybercriminals foam at the mouth for the chance to breach their databases. A single data breach will not only compromise sensitive client data, but the cost is astronomical: legal fees, emergency IT recovery and support, insurance claims (if you have a policy), and undoubtedly the reputation of the agency.

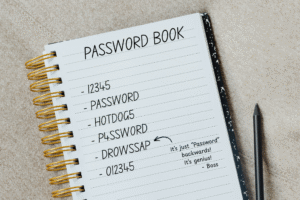

When it comes to protecting the sensitive database at your agency, take a lesson from of the Boy Scouts of America motto: “Be Prepared.” Implementing the proper safeguards and cybersecurity measures now will help protect your agency from unwanted cyberattacks. To be prepared, ensure that your agency implements strong password policies and multi-factor authentication (MFA).

Passwords should be strong, utilizing different letters, numbers, and symbols throughout (no one should use “password123” or “agencyname2025”). Dedicated password managers can generate complex passwords, and the best of those managers will have encrypted databases to store them safely and securely.

Additionally, MFA should be enabled across every account that has access to sensitive information. If this isn’t enabled, all it takes is one leaked password to breach your entire system. Whether it be a dedicated authenticator app from Microsoft, Google, or another third-party or utilizing phone MFAs, your agency needs to implement this safeguard if you haven’t already.

But what about when you need to send, store, or receive that sensitive data? Data encryption can and will protect files that contain sensitive client data, which adds an extra layer of reinforcement and security to your systems. Some agency management systems (AMS) offer encryption services within their suites, so make sure your agency is taking full advantage of this cybersecurity feature.

If you are unsure of where your agency should start or how to implement these changes, all you have to do is reach out to us for a free consultation on how to begin to implement these security features. Working with and receiving guidance from seasoned IT professionals who specialize in the insurance industry will make implementing the best practices much easier for your agency.

Meeting Compliance Requirements

As technology advances, the compliance requirements for insurance agencies change and get stricter. It’s easy to think that you’ve met all the requirements while you’re still missing something that will leave your agency liable to a lawsuit, fines, and devastating loss that your agency may not be able to recover from.

The first step is to determine and understand the key regulations that govern your agency. There are many federal regulations from the US government that your agency to which your agency should be compliant, such as the Gramm-Leach-Bliley Act (GLBA) that requires robust security, data-sharing restrictions, and privacy notices; or the Health Insurance Portability and Accountability Act (HIPAA) that governs health insurers in regards to data usage, disclosure, and security.

Beyond US-federal regulations, individual states may have regulations and departments to which your agency is subject, such as New York’s Department of Financial Services (DFS); or California’s multiple regulations such as California Consumer Privacy Act (CCPA), California Privacy Rights Act (CPRA), and/or California Financial Information Privacy Act (CFIPA).

To make sure your insurance agency is meeting these regulations and laws, there are a few things that your agency can do to ensure that you’re compliant. First, regular IT audits will ensure that your systems meet the ever-changing regulatory landscape. Second, your agency can implement documentation and reporting tools to not only cover compliance requirements but also to keep your agency and client data secure. Third, your agency can partner with IT professionals and consultants who specialize in the insurance industry and are familiar with regulations and compliance.

Relying on Outdated or Fragmented Technology

How old is the technology at your agency?

Are your devices still receiving updates to patch critical flaws in the system? Or are your devices still operating under old and outdated versions (i.e. Windows 10, macOS 13 Ventura, or even older versions)?

Leaving your technological environment in the hands of outdated technology is playing with a ticking time bomb that will almost certainly end badly for your agency. Whether it be lost data in an unrecoverable crash, a data breach from outdated security measures, or lost time and productivity from slow devices, the costs of outdated technology will eventually catch up with your agency.

To mitigate this issue, it’s important for your agency to do a deep-dive scan and discover when devices were purchased and if they’ve reached the end of their lifespan. Checking the hardware and software details through a computer’s system information can reveal key details about what Operating Systems, processors, RAM, and other specifications a computer has installed. Additionally, the purchase date of a device can tell you if it’s time to replace. Computers and servers over 3-5 years old have likely reached the end of their lifespan, though some can reach upwards of 8-10 years of use. Trying to extend the lifespan of a device is not recommended, especially if it begins to slow down or can no longer receive updates.

It may be frustrating to purchase and install all new equipment, but with a proper IT roadmap, this cost can be factored into the budget ahead of time instead of being a surprised cost. Planning this way allows your agency to strategically plan around technology and incorporate it into the growth goals and desires for your agency. Also, it’s much cheaper to replace these devices than to pay for emergency data recovery services or the crushing cost of a security breach.

Turn IT Challenges into Opportunities

These aren’t the only issues that the insurance industry faces today, but they are some of the most common ones that we come across.

Insurance agencies that proactively address IT challenges don’t just protect themselves: they gain a competitive edge with clients who value security, reliability, and efficiency. Insurance agencies that push off these challenges for another day, however, get left behind and suffer lost productivity, money, and data.

Don’t let your agency get hindered by the challenges of technology. If you need help overcoming one of these challenges (or the many others you may be facing), feel free to reach out! With over 20 years of experience in the insurance industry, our team is here for you.